The Psychology of Money — Why We Make Poor Financial Decisions

Money isn’t just a matter of numbers.

It’s a reflection of our emotions, upbringing, habits, and even our fears.

That’s why two people with the same salary and similar life circumstances can end up in very different financial situations — one building wealth steadily, the other constantly struggling.

The difference often comes down to how they think and feel about money, not just what they know about it. Understanding the psychology behind money can be the first step toward making better decisions and achieving true financial security.

1. Why We Don’t Always Act Rationally with Money

Behavioral economics — the study of how psychology influences financial decision-making — reveals a truth most people don’t like to admit:

We are not purely logical when it comes to money.

Our brains are wired with certain cognitive biases that push us toward emotional, short-term decisions. Here are some of the most common:

Loss Aversion

We feel the pain of losing $100 far more intensely than the joy of gaining $100.

This fear of loss often makes us overly cautious — avoiding investments or opportunities that might actually benefit us in the long run.

Instant Gratification

Our natural tendency is to prioritize rewards now over rewards later.

This can lead to overspending today instead of saving for tomorrow, even when we know it’s not a smart move.

Herd Mentality

If everyone around us is doing something — whether it’s buying a certain brand, investing in a trending stock, or upgrading their lifestyle — we feel pressure to do the same, even if it’s not right for us.

Herd Mentality

A few lucky wins in the market or some successful financial decisions can make us believe we’re “money smart,” leading to risky or poorly thought-out moves.

2. Your Money Story — The Silent Influencer

Beyond biases, our relationship with money is often shaped by something more personal: our money story.

This is the set of beliefs and feelings about money that we’ve absorbed from our families, culture, and early life experiences.

If you grew up in a home where money was scarce, you might associate it with stress and fear — leading you to avoid risks or hoard resources.

If you grew up in a home of abundance, you might view money as something that’s always available — which can make you too casual about saving.

If you were taught that talking about money is “impolite,” you may struggle to seek advice or negotiate for your worth.

Your money story can either empower you or hold you back — but until you recognize it, it operates in the background, quietly influencing your choices.

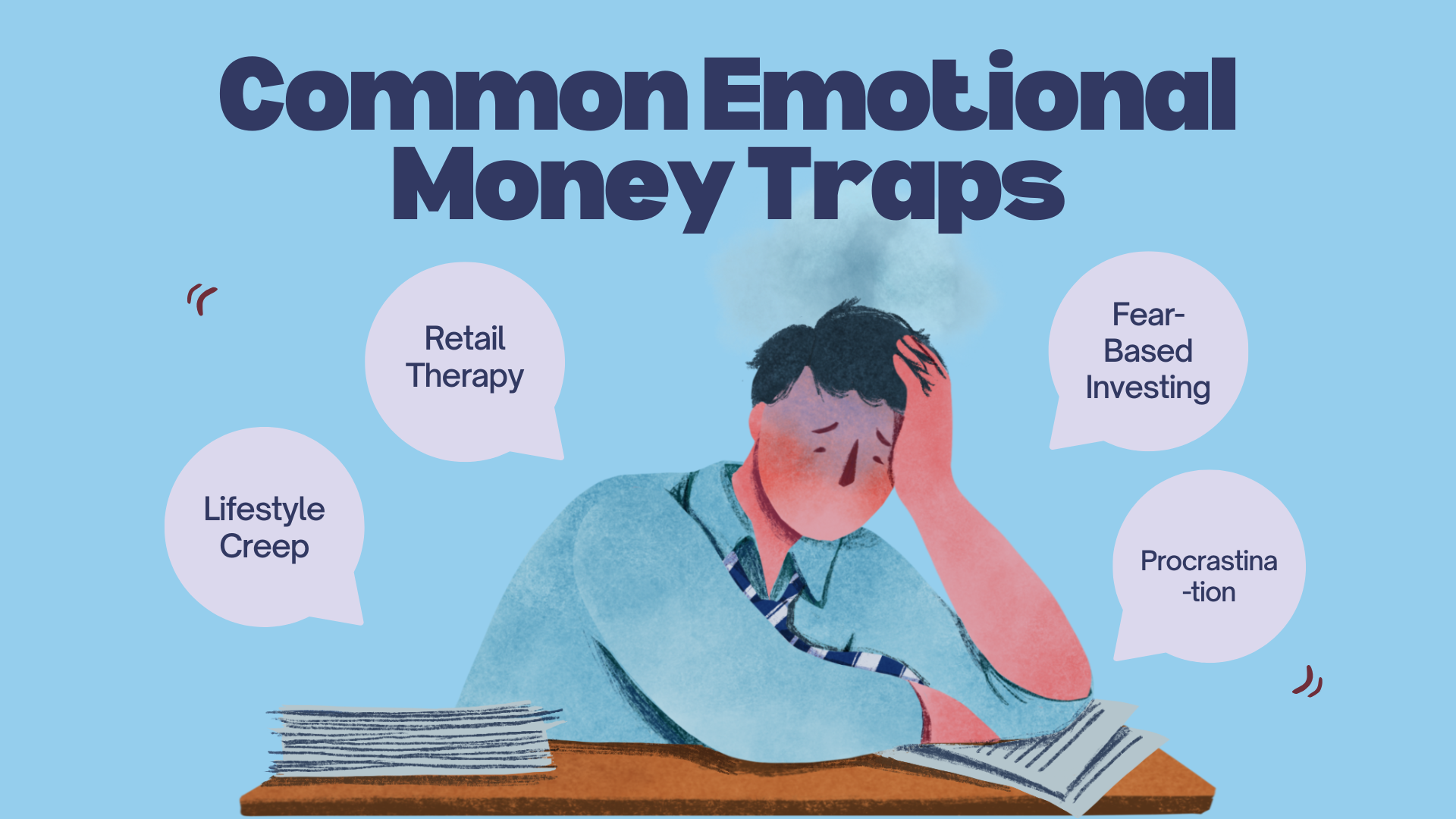

3. Common Emotional Money Traps

Here are a few ways psychology trips us up in everyday life:

Retail Therapy – Shopping to boost mood, which creates short-term happiness but long-term regret.

Lifestyle Creep – Spending more as income rises, instead of using that extra money to build savings and investments.

Fear-Based Investing – Selling off investments during market dips, locking in losses instead of riding out volatility.

Procrastination – Delaying financial planning because it feels overwhelming or uncomfortable.

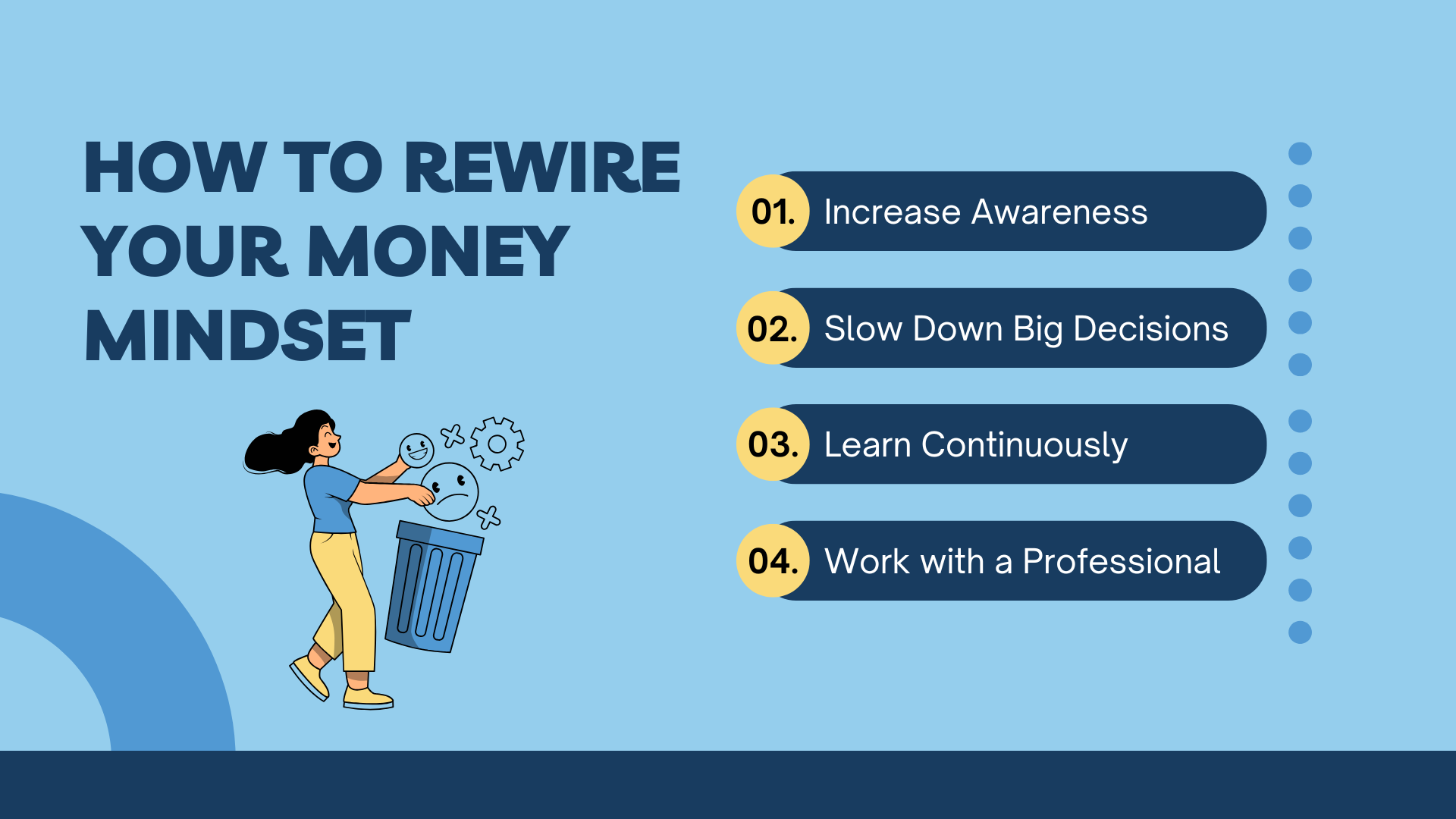

4. How to Rewire Your Money Mindset

The good news is that while our biases and money stories are powerful, they’re not unchangeable. Here’s how to start improving your decision-making:

Step 1 – Increase Awareness

Notice your spending triggers and emotional patterns. Ask yourself: “Is this decision based on logic or emotion?”

Step 2 – Slow Down Big Decisions

Instead of making financial choices in the heat of the moment, give yourself 24 hours to think them over.

Step 3 – Learn Continuously

The more you understand about how money works — budgeting, investing, protecting assets — the easier it becomes to balance emotion with fact.

Step 4 – Work with a Professional

An outside perspective can help you spot blind spots and challenge your assumptions.

The Bottom Line

Your financial life isn’t just shaped by what you earn or what you know — it’s shaped by how you think.

By understanding the psychology of money, you can recognize the invisible forces influencing your decisions and take control of them.

When you master both the numbers and the mindset, you create a powerful combination — one that helps you make smarter choices, avoid emotional traps, and confidently build the future you want.